Seeking investors for your app startup? This guide covers key strategies to attract application investors, including angel investors, venture capitalists, and crowdfunding. Learn what these investors seek and how to make your app stand out.

Key Takeaways

-

Understanding the various types of investors—angel, venture capitalists, and crowdfunding platforms—allows startups to tailor their approach and secure the right support.

-

A strong elevator pitch, comprehensive pitch deck, and validated app idea are essential for attracting and engaging potential investors.

-

Navigating different funding stages—pre-seed, seed, and Series A/B—requires specific strategies and clear communication of growth potential to secure necessary capital.

Top Strategies to Attract Application Investors for Your Startup

Navigating the competitive world of mobile apps requires more than just a unique app idea; it demands significant funding and strategic planning. Mobile app investors, including angel investors, venture capitalists, and crowdfunding platforms, are crucial in providing the resources and expertise needed to bring your app to life. Investors prefer opportunities in markets where they have existing knowledge, and they can offer competitive advantages, such as implementing unique features and marketing strategies to help your app stand out.

Attracting the best investors involves more than just showcasing an innovative app concept. It requires a compelling argument that proves why your app is worthwhile, backed by thorough research and a clear understanding of what investors are looking for. This includes demonstrating market potential, scalability, and a strong leadership team.

Understanding the different types of investors and the specific benefits they offer allows you to tailor your approach and secure the necessary funding for various stages of app development.

Introduction

This comprehensive guide covers essential aspects of attracting application investors for your startup. From understanding different types of investors and funding stages to crafting a compelling pitch and preparing your app for evaluation, you’ll find valuable insights to help you navigate the investment landscape.

Upon completing this guide, you’ll have the knowledge to secure funding and turn your app vision into reality.

Understanding Different Types of Application Investors

Investors can be the lifeline for your mobile app startup, but not all investors are the same. Understanding the various types of mobile app investors, such as angel investors, venture capitalists, and crowdfunding platforms, is crucial for tailoring your approach to secure the right kind of support.

Each type of investor brings unique benefits and focuses on different aspects of app development, making it essential to know who you’re pitching to and what they expect in return.

Angel Investors

Angel investors are typically individuals who provide early-stage capital and mentorship in exchange for equity in your startup. They often invest in exchange for 10% to 30% equity and offer valuable insights to help navigate the startup landscape.

To attract angel investors, focus on presenting unique app ideas that fill market gaps and demonstrate innovation. Thorough groundwork, including a well-defined strategic plan and a comprehensive pitch, is essential to appeal to these early-stage investors.

Venture Capitalists

Venture capitalists are interested in high-potential startups and provide significant funding during the expansion stage in exchange for equity ownership. They typically invest larger sums compared to other investors and focus on scalability and market reach, often collaborating with venture capital firms.

To attract venture capital funding, your app must offer significant growth potential, and you must demonstrate industry experience and knowledge.

Crowdfunding Platforms

Crowdfunding platforms allow entrepreneurs to raise funds from many small investors by offering rewards or early access to products. Platforms like Kickstarter and Indiegogo are commonly used to gather funds from a broad audience, helping to expand your reach and potential investor base.

This method can be particularly effective for startups looking to validate their app idea and build a community of early adopters.

Steps to Gain Trust and Secure Funding from Application Investors

Gaining the trust of app investors requires a well-defined investment strategy and an understanding of what investors are looking for. Investors evaluate the team’s capabilities, market opportunities, and potential profitability before committing funds. Demonstrating scalability and a strong leadership team with proven success can significantly enhance your chances of securing funding.

To attract investors, it’s essential to present a unique selling proposition (USP) that sets your app apart from the competition. This involves thorough market research, identifying innovative features, and staying ahead of market trends. Understanding the competitive landscape and addressing investor needs enables you to craft a compelling pitch that highlights your app’s potential.

Validate Your App Idea

Validating your app idea is crucial for attracting investors, as it proves that your concept has potential. Conduct thorough market research to identify target users, their needs, and how your app can effectively address those needs.

Gathering user feedback on an initial prototype can refine your app’s features and validate the market demand for your solution. Demonstrating that your idea resolves real problems in a unique way and proves market demand is key to gaining investor interest.

Develop a Strong Elevator Pitch

An elevator pitch is a concise presentation of your app idea. It usually lasts between 30 seconds to one minute and highlights the concept along with its potential benefits. Investors are busy and may consider scheduling a call based on your pitch, so it should highlight the product’s unique value proposition (USP), competitive aspects, and potential for profitability.

The goal is to grab investor interest for further communication and potentially a longer personal meeting and pitch deck opportunity.

Create a Comprehensive Pitch Deck

A compelling pitch deck is essential for attracting investor interest and should include problem-solving elements, financial projections, and a clear description of the app and its unique selling proposition. The pitch deck should also outline the app’s market analysis and competitive landscape, demonstrating scalability and long-term potential.

Keeping the pitch deck concise, typically consisting of nine to twelve slides, helps maintain clarity and focus.

Preparing Your Mobile App for Investor Evaluation

Before approaching investors, it’s crucial to prepare your app for evaluation by creating a Minimum Viable Product (MVP), conducting thorough market research, and defining a clear revenue strategy. An MVP helps investors visualize the app’s functionality and increases the likelihood of investment. Market research is essential to prove there is sufficient market size and customer base for the product. A well-defined revenue strategy outlines how the app will generate revenue and provides realistic financial projections.

Creating UX mockups and UI concepts can provide a tangible preview of the app’s look, feel, and functionality, gaining investor interest. If you are not a developer, consider outsourcing your app to a development company to enhance your project’s appeal to investors. A reliable app development partner can also provide the latest industry expertise and technologies, helping to secure funding.

Build an MVP (Minimum Viable Product)

Building an MVP is essential as it shifts the project from an idea to a tangible product that investors can evaluate. An MVP provides potential investors with a physical product they can see and use, helping them understand the app’s potential and workflow.

It also offers flexibility for tweaks based on user feedback, which is critical during the seed funding stage when refining the product and initiating market testing.

Conduct Thorough Market Research

Market research is crucial to proving there is sufficient market size and customer base for your app. Performing market analysis helps you understand market trends, audience preferences, and competitor information. Researching the competition in your app’s niche allows you to identify unique offerings that can set your app apart.

Conducting a thorough market analysis before engaging with investors aids in making informed decisions and demonstrating financial potential.

Define Your Revenue Strategy

Defining a clear revenue strategy is crucial for attracting investors. Monetization models can include in-app purchases, subscriptions, ads, and premium versions. Choosing the right model depends on the app’s purpose and user engagement, and understanding your target audience is essential to determining the appropriate pricing strategy.

Revenue projections should be based on market trends and realistic growth expectations, outlined in a solid financial model.

Engaging with Potential Investors

Engaging with potential investors requires more than just presenting a good app idea; it involves making a strong initial impression and demonstrating seriousness about the product. Presenting a Minimum Viable Product (MVP) can show investors that you are committed and provide them with a real-time usage experience. Leveraging personal networks, participating in funding contests, and approaching private investors are effective ways to raise funds and gain investor interest.

Having a skilled team working on the app can significantly increase your chances of meeting user and investor expectations. A good app development partner can help impress investors with the app’s features and functionalities, making it a crucial aspect of the engagement process.

Strategically engaging with investors helps secure the funding required to elevate your app to the next level.

Leverage Personal Networks

Leveraging personal networks can significantly aid in finding initial investors who align with your startup’s vision. Local businesses that align with the app’s niche can be valuable sources for investment, and engaging with your network should be an ongoing strategy to attract further investment opportunities.

Investors who come through personal networks are often more likely to trust and support your vision due to established relationships.

Participate in Funding Contests

Participating in funding contests allows entrepreneurs to showcase their app concepts and draw potential investors. Before entering an app funding contest, it is essential to meticulously plan for it, as these contests often feature tough competition, with up to a thousand opponents participating.

Funding contests provide an excellent opportunity to gain visibility and attract investors who are looking for innovative app ideas.

Approach Private Investors

Approaching private investors can be particularly effective when your app targets a specific niche. Identifying investors who understand and are passionate about your market can make a significant difference. Ensure your pitch clearly articulates your app’s value proposition while addressing the specific interests of the investors.

Utilizing storytelling techniques in your pitch can help investors visualize the impact of your app, making it more relatable and compelling. Presenting data on market trends and user demographics shows investors the potential reach and return on investment for your app.

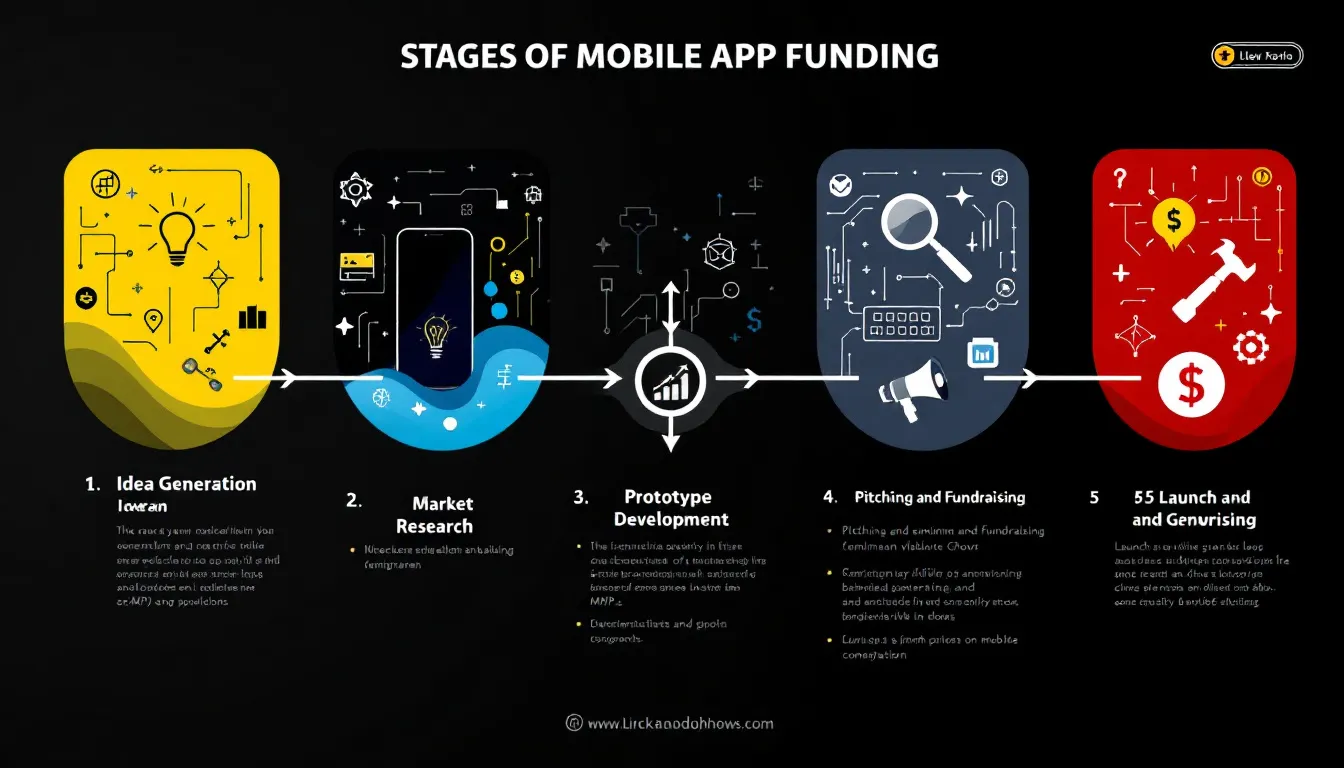

Navigating Different Stages of Mobile App Funding

Funding for mobile app startups generally occurs in distinct phases, each necessitating different monetary amounts and strategic approaches. The stages of mobile app funding include:

-

Pre-seed

-

Seed

-

Series A

-

Series B

-

Beyond

Each stage allows startups to undergo modifications and milestones, with investors assessing the growth potential of the app and seeking opportunities beyond its initial launch. Understanding these stages and how to navigate them is crucial for securing the necessary funds at each step of your startup’s journey.

Each funding round has its specific focus and requirements. Pre-seed funding focuses on business setup and product development, while seed funding aims at refining the product and beginning market testing.

Series A, B, and beyond funding rounds are geared towards scaling operations, expanding market reach, and achieving significant growth. Aligning your funding strategy with these stages effectively attracts investors and secures the resources necessary to propel your app forward.

Pre-seed Funding

Pre-seed funding is the earliest stage in the funding process, focusing on business setup and product development. Common funding sources in the pre-seed phase typically include personal savings, contributions from friends and family, and very small grants. Bootstrapping often involves self-funding using personal savings or borrowing from loved ones.

It’s important to carefully consider how much funding is needed based on various factors before seeking investments. During this stage, the main objective is to gain traction independently and present a functional prototype to convince early investors about the viability of the app idea.

Seed Funding

The seed funding stage focuses on refining products and beginning market testing, which are critical steps in preparing for a wider launch. Typical investors in the seed funding round include angel investors, early-stage venture capitalists, and startup incubators. Startups are expected to present a working business model, conduct market analysis, and have a team focused on risk mitigation and product assembly.

Seed funding typically ranges from $1 million to $2 million, supporting app development, marketing efforts, user acquisition, and scaling up operations while conducting market testing.

Series A, B, and Beyond

The goal of funding in Series A, B, and beyond is to scale operations and expand market reach. Series A funding marks the onset of active growth for a startup, where venture capitalists typically become involved. During Series A and B funding, startups need to showcase growth potential and a path toward scalability.

Series B funding can help startups broaden their reach, speed up development, and improve their product, with typical investments averaging around $24.9 million. Subsequent funding rounds, like Series C, focus on large-scale expansion, product diversification, and strengthening the market position.

Maximizing Post-Funding Success

Securing funding is just the beginning; maximizing post-funding success is crucial to ensure your app’s long-term viability and growth. After receiving investment funding, it’s essential to bring your mobile app vision to life by hiring experienced developers and a reliable app development partner. Utilizing funds to add features, improve design, and scale the business post-launch can significantly enhance user satisfaction and retention. Maintaining user satisfaction is essential for sustaining investor interest and securing further funding.

Continuous improvement and user feedback play a vital role in keeping your app relevant and engaging. Implementing regular updates with new features and enhancements can boost user engagement and ensure your app meets evolving market demands.

Strategic marketing and growth efforts, funded by investors, can significantly boost app visibility and user acquisition, helping you reach a broader audience and achieve sustained growth.

Continuous Improvement and User Feedback

Continuous improvement and maintenance of the app are essential after receiving funding to meet market demands. Investors not only provide financial support but also act as strategic partners, offering valuable insights for continuous improvement.

To keep users engaged, it is crucial to implement continuous updates with new features and enhancements that improve the user experience.

Hiring a Skilled Development Team

Collaborating with experienced developers enhances the likelihood of achieving user and investor satisfaction. When choosing an app development partner, prioritize their experience with similar projects and ensure they have a capable team.

Select an app development company that has relevant experience in your app’s niche to increase the chances of success in mobile app development. Investing in a capable team is crucial for handling app maintenance and future updates.

Strategic Marketing and Growth

Utilizing funding acquired from investors allows startups to implement robust marketing strategies. Effective marketing strategies funded by investors can significantly boost app visibility and user acquisition. Investing in targeted marketing efforts enables startups to reach a broader audience and convert more users.

Engaging users through ongoing marketing initiatives also plays a key role in maintaining user retention.

Summary

Securing funding for your mobile app startup involves understanding different types of investors, crafting a compelling pitch, and preparing your app for evaluation. By leveraging personal networks, participating in funding contests, and approaching private investors, you can attract the right kind of support. Navigating the various stages of mobile app funding and maximizing post-funding success are crucial for achieving long-term growth and sustainability. With the right strategies and a clear understanding of the investment landscape, you can bring your app vision to life and make a significant impact in the market.

Frequently Asked Questions

How do you get investors?

To attract investors, leverage social networking platforms, attend networking events, and connect with angel investor groups. Additionally, consider crowdfunding, engaging with incubators, and seeking funding from friends and family to broaden your outreach.

How do I pitch an app to an investor?

To effectively pitch your app to an investor, focus on demonstrating the investment opportunity rather than just the product itself. Clearly outline the app's unique features, market fit, and potential return on investment to engage and persuade them.

What are the main types of investors for mobile app startups?

The main types of investors for mobile app startups are angel investors, venture capitalists, and crowdfunding platforms, each offering distinct advantages depending on the stage of development. It's crucial to choose the right type of investor to align with your startup's needs.

How important is validating my app idea before seeking investment?

Validating your app idea is essential before seeking investment, as it demonstrates to potential investors that your concept has market viability and addresses real customer needs. This validation can significantly increase your chances of securing funding.

What should be included in a pitch deck to attract investors?

To attract investors, a pitch deck must include problem-solving elements, financial projections, a clear description of your product, its unique selling proposition, market analysis, and evidence of scalability. Ensuring these components are well-articulated can significantly enhance your chances of securing investment.

Tags:

Attracting App Investors, Angel Investors for Startup, Venture Capital for Apps, Validating App Ideas, Startup Investor Engagement, Mobile App Funding Strategies, Crowdfunding Platforms for Apps, App Pitch Deck Tips, Securing App Investment, Mobile App Growth FundingNov 22, 2024 8:00:00 AM

.png?width=301&height=50&name=Website%20%20Images%20(24).png)